Analyzing the Banking-as-a-Service Value Chain

Listen to this article in podcast form:

Banking-as-a-Service (BaaS) has been the subject of much excitement in fintech over the past few years, together with the related but more general concept of embedded finance. The proliferation of APIs capable of connecting disparate data and services means digital product offerings can quickly and easily be composed from components sourced from many different places.

First a little background...

Partnerships between companies offering complementary services have always existed, but APIs allow for greater scale, more efficient delivery and self-service.

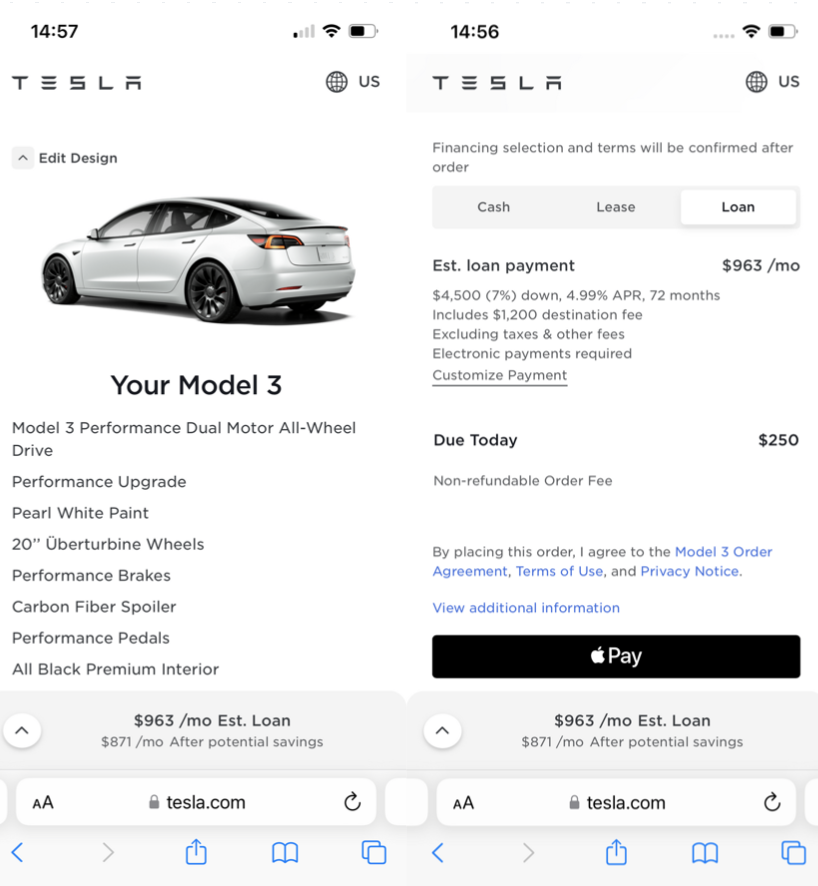

Traditionally, car dealers may have referred customers to partner lenders or leveraged centralized auto finance business units to help consumers buy their cars.

Source: Wells Fargo Archive

Today, a developer can build a car buying app and embed a lending partner into the checkout flow via API, with the parties tailoring and underwriting loans based purely on communication between software applications. In fact, fintech lending companies built today can reasonably decide to only offer an API, without any front end whatsoever.

The value chain is optimized, we're told, across origination, distribution and any intermediate or ancillary services such that companies can specialize in just one.

BaaS extends this API-based finance concept to more banking services, including checking, savings, debit cards, credit cards, lending and more. Modern BaaS platforms are purpose-built to deliver banking services to non-banks via API.

Neobanks like Chime, brokerage apps like Robinhood, and hundreds of other consumer and business fintechs have built their offerings atop BaaS providers, allowing the delivery of regulated products without the fintechs becoming licensed or holding the capital themselves.

This model is coming under increasing scrutiny from banking regulators and could eventually be impacted by new rules. These developments are not the focus of this piece, but readers should follow Jason Mikula's work for more on this evolving topic.

Instead, I'd like to take a closer look at the BaaS/neobank value chain, which I argue is not currently in equilibrium and predict will evolve.

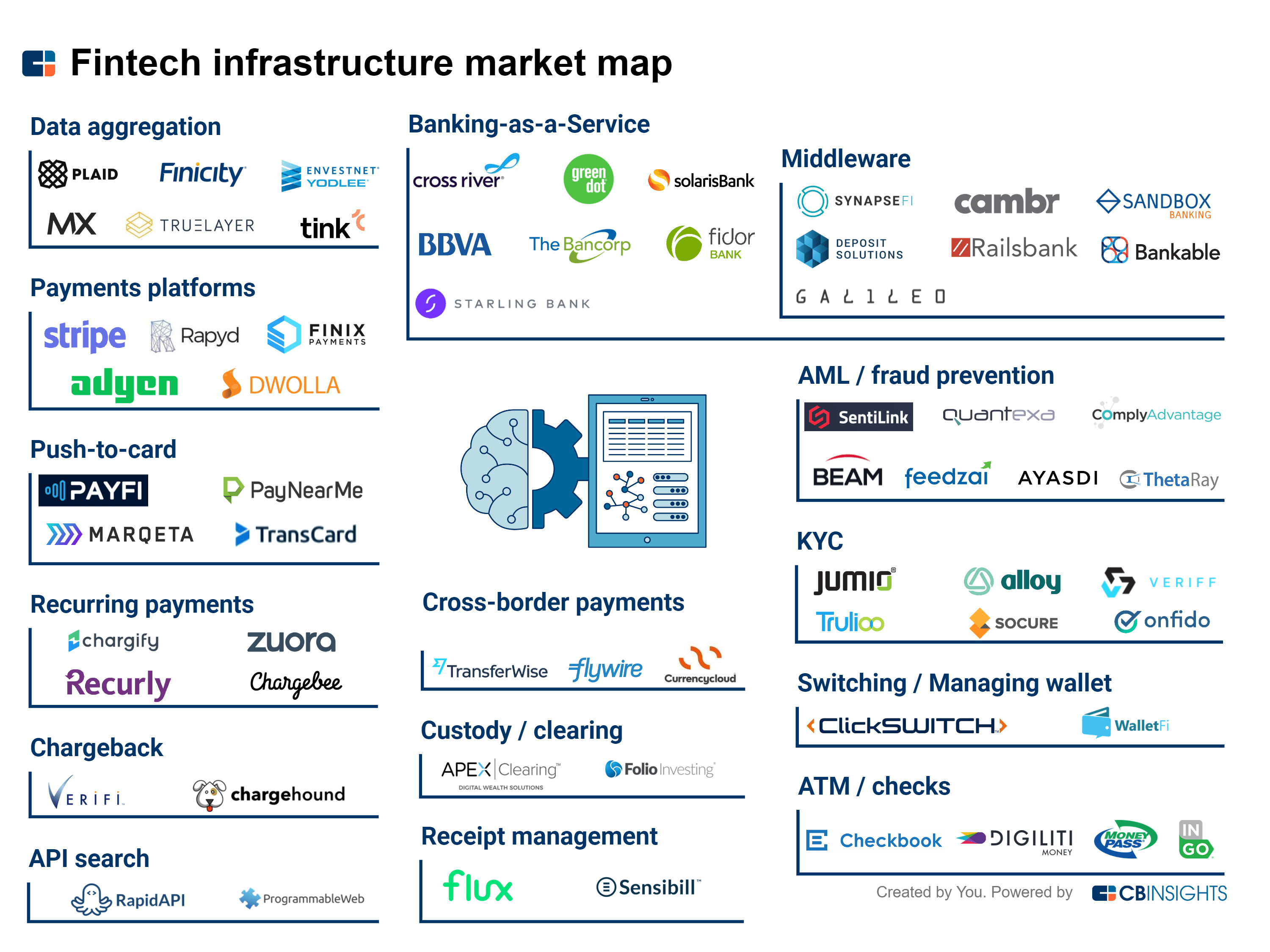

The value chain is complex, and the landscape of companies providing services is very crowded.

Source: CB Insights

There are four main participants in this value chain, offering distribution, orchestration, product creation and connectivity/optimization, respectively:

- Customer-facing fintechs/tech companies (the "last mile." Customers = consumers or businesses)

- BaaS platforms (software companies offering banking products and core banking via API)

- Banks/regulated FS companies ("product manufacturers" that hold licenses and capital. The ultimate deposit holder in the case of checking/savings accounts. Occasionally, banks offer the APIs/software layer as well)

- Ancillary service providers (KYC, AML, fraud, card services, payment services, data aggregators etc)

These participants earn the following revenues:

- Customer-facing fintechs/tech companies: Interchange, subscription fees, cross sales, interest share

- BaaS platforms: license fees, account fees, transaction/processing fees, service fees

- Banks/regulated FS companies: interchange, interest (NIM generated on deposit balances), service fees, program fees

- Ancillary service providers: pay per use fees, license fees, transaction/processing fees

In the current market, value capture is disproportionately skewed toward BaaS platforms & ancillary service providers at the expense of the fintech/tech company "last mile."

Fintechs rushed to offer free or low-cost services to consumers and business customers, limiting their revenue potential, while B2B API providers - the "picks and shovels" of embedded finance - face no such pricing constraints.

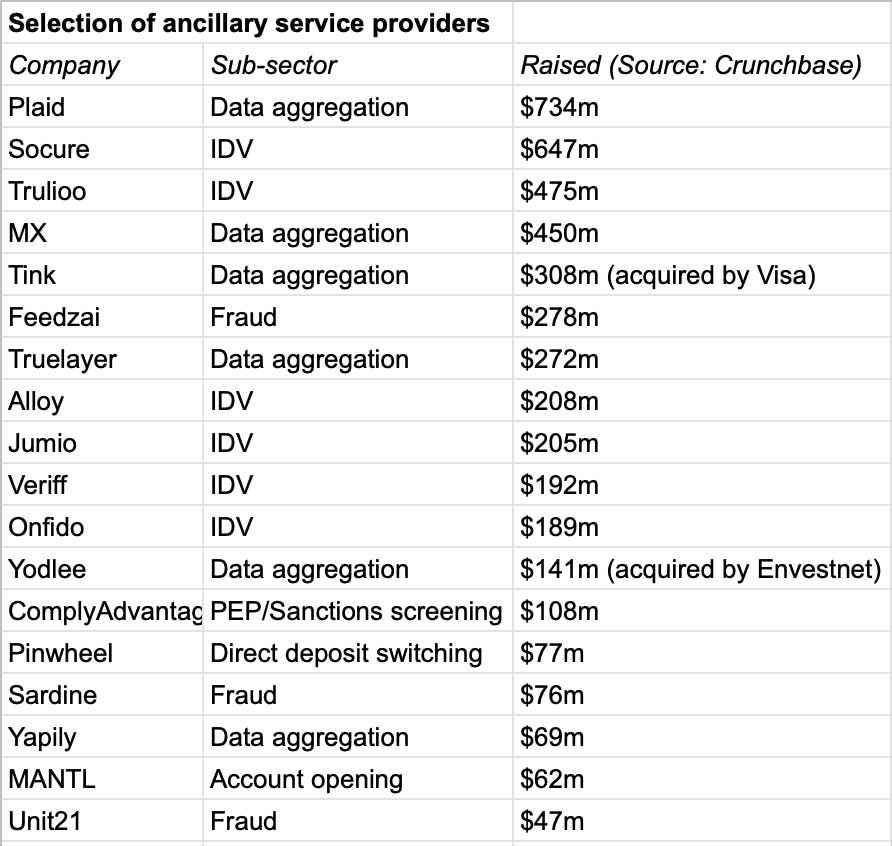

As an indication of the value accrual to these components of the value chain, observe fundraising activity, below. What value capture expectations are baked into these raises/valuations?

Source: Rebank, based on Crunchbase data

BaaS

Here, I refer to non-bank software companies offering the connectivity between sponsor banks and fintechs, generally including core banking and payment services. Some legacy players came to this business by extending traditional cores to support the sponsor bank model. Other providers started in payments and extended into BaaS. Some startups launched with the express purpose of building API platforms to run atop banks.

An entirely different set of BaaS providers are actually banks themselves that also offer API infrasturcture to fintechs. Examples include Green Dot, Cross River and BBVA.

In short, there are various approaches to this layer of the value chain. It is a fundamental component of the stack. It is currently expensive and does not get sufficiently cheaper with scale from the standpoint of last mile fintechs.

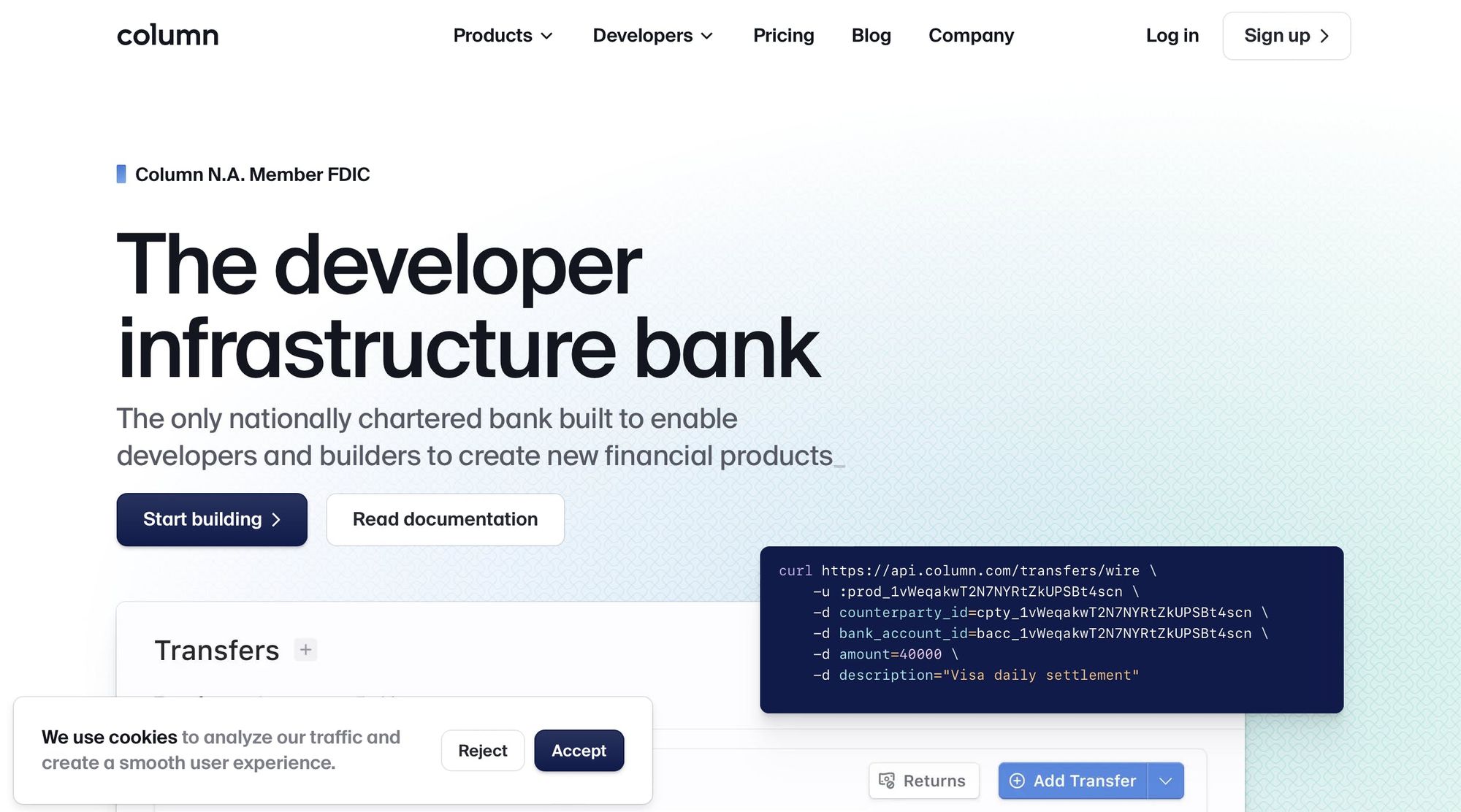

The natural value chain optimization would be for BaaS and regulated, capitalized banks to merge and offer a developer-focused, self-service approach to implementation. Column is following this path and will be an interesting case study, though they are reportedly facing regulatory challenges.

Rumored headwinds notwithstanding, Column is positioning as the Stripe of banking.

Source: Column

Source: StripeExtrapolating beyond Column itself, a robust, truly tech-first, developer-focused BaaS platform with a banking license is the natural evolution of this model. There are currently a very small number of banks and fintechs that could credibly pursue this path if they fully committed to it.

Ancillary service providers

Some offerings are differentiated and high value for a specific use case, like Sardine for real-time fraud prevention in fiat-crypto onramping and Pinwheel for direct deposit switching, important functionality for consumer neobanks.

As valuable as these specific services are, the math doesn't add up in the aggregate for many "last mile" fintech companies. If you're a neobank customer of a few different ancillary service providers, your cost base to service an account quickly becomes signficant, especially if you seek to offer a range of products to customers. Giving your product away for free is unsustainable given this cost structure.

Counterintuitively, "free banking" was easier to justify as a business model prior to the proliferation of so many ancillary services!

The counter to this point is that it's perhaps the economics of consumer fintech that are the problem, not the cost of the infrastructure. There's certainly merit to that argument, too.

Banks

Banks, ultimately the most fundamental piece of the value chain, generally position their embedded finance aka fintech partnerships businesses to succeed when last mile fintech partners achieve significant scale, which has not necessarily materialized.

Data confirms the balance sheet benefits of providing sponsor banking services, though that's only part of the equation. A recent analysis by S&P shows that among banks with assets between $1bn-$3bn, fintech sponsor banks grew deposits by 15% annually over the past three years, compared to non-sponsor bank peers at 3%. I expect some self-selection in these figures, as sponsor banks generally get into the business with the goal of growing deposits. It's unknown whether all banks in the peer group were targeting such deposit growth.

Deposit growth from sponsor banking comes with costs. Banks must invest, potentially heavily, in operations, technology, compliance and headcount to support the partnerships business. The expected increased regulatory scrutiny on sponsor banks would only further increase the cost of providing these services.

Taken together, I would be surprised if many fintech sponsor banks were providing these services profitably today. It will be interesting to see what impact a rising rate environment combined with a slowdown in consumer fintech usage has on fintech sponsor bank economics.

I'm as bullish on embedded finance as anyone else, with payments and lending the low-hanging fruit, but it's clear that the value chain must evolve if richer product configurations are to be sustainable.

As for auto financing, it's a single tap now...

Source: www.tesla.com