Fintech as Consumer Discretionary & Why It Matters

One framework I have for thinking about fintech involves three simple categorizations: fintechs as financial institutions, fintechs as tech companies, and fintechs as consumer discretionary businesses.

This framework is particularly useful for consumer & SMB fintech, but it can often be extended to B2B, too.

Depending on the audience, market conditions and funding environment, these classifications cycle in relevance. They are probably all equally "right," but the consensus categorization at any given time (whether or not explicitly stated) creates a lens through which the industry sees.

As they persist and spread to a critical mass in our space (specifically founders, investors and the media), lenses become narratives, powerful forces that guide the thinking and behavior of most stakeholders.

The lens through which the industry, a sub-sector or an individual company sees and is viewed can have a significant impact on its success.

Our stories

In the early days of fintech, founders were very clearly positioning against financial incumbents by building better, faster, cheaper, digital versions of the same products.

We did this at Allica, my first fintech company circa 2015, a de novo digital bank in the UK. We used a modern tech stack to build a better bank for SMBs. We raised money from traditional financial services investors who understood our story.

Because we were a "fintech as financial institution" and a bank, we were valued at price-to-book, which was much lower than the valuations at which other fintechs would later raise.

In retrospect, this approach was right for Allica, and the business has done great, thanks to its amazing leadership team.

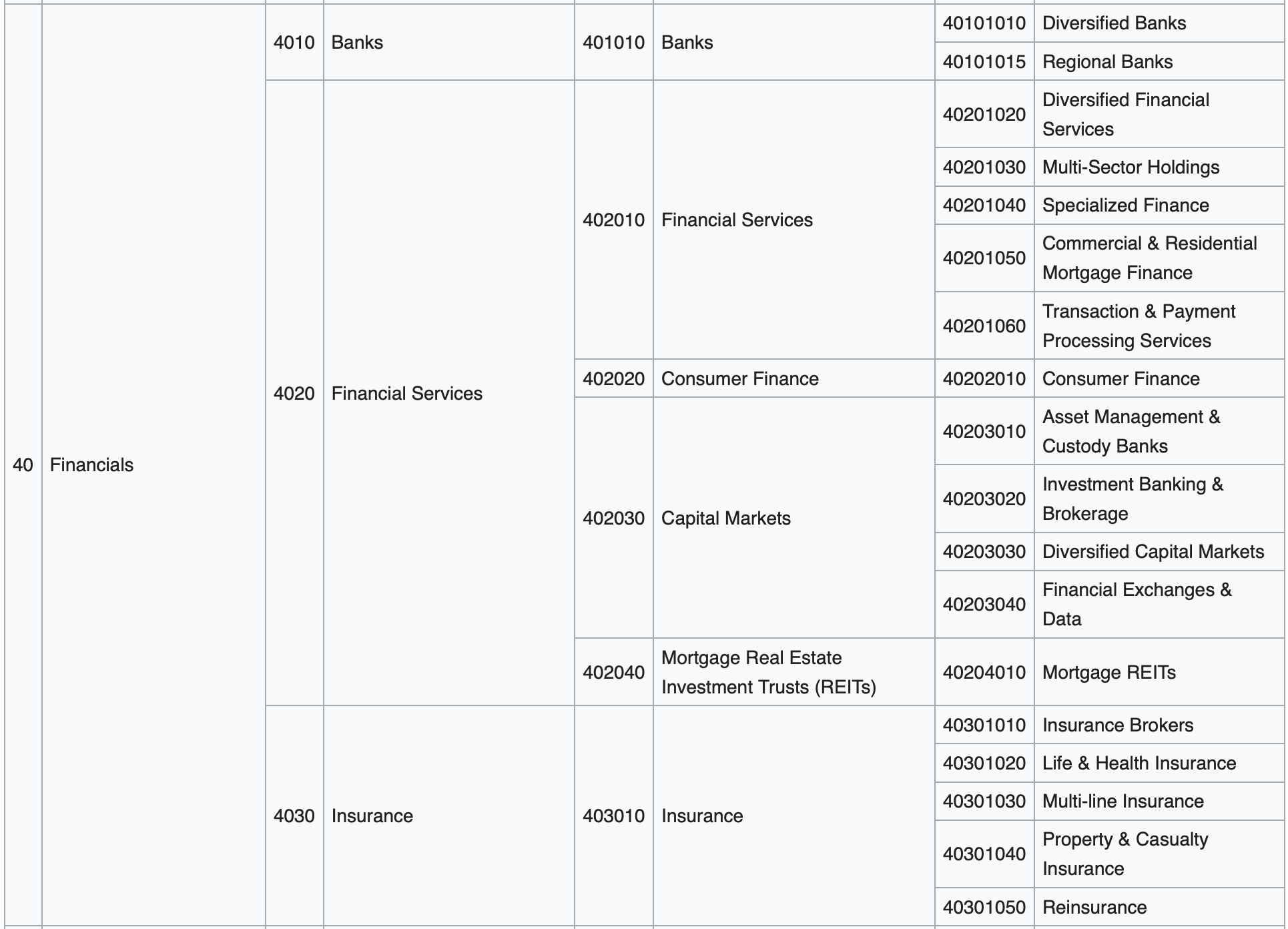

Here's a map of the Financials GIC code as a reference:

Over time, in part due to the difficulty of competing with financial incumbents head on, fintech evolved to adopt tech company positioning, an industry characterized by much higher, customer- or revenue-based valuations.

This positioning worked great in a cash-rich, risk-on macro environment, helping fintechs raise large amounts of money at high valuations, hire great talent, and spend aggressively on customer acquisition.

Ultimately, however, macro conditions changed, and the results have been horrific.

Whether or not fintechs are analogous to financial incumbents or tech companies, most actually display many characteristics of consumer discretionary businesses.

Consumer discretionary companies can grow fast when their products are shiny and fun and people want them, and that's good. There's no better way to acquire customers cheaply than social confirmation of your product.

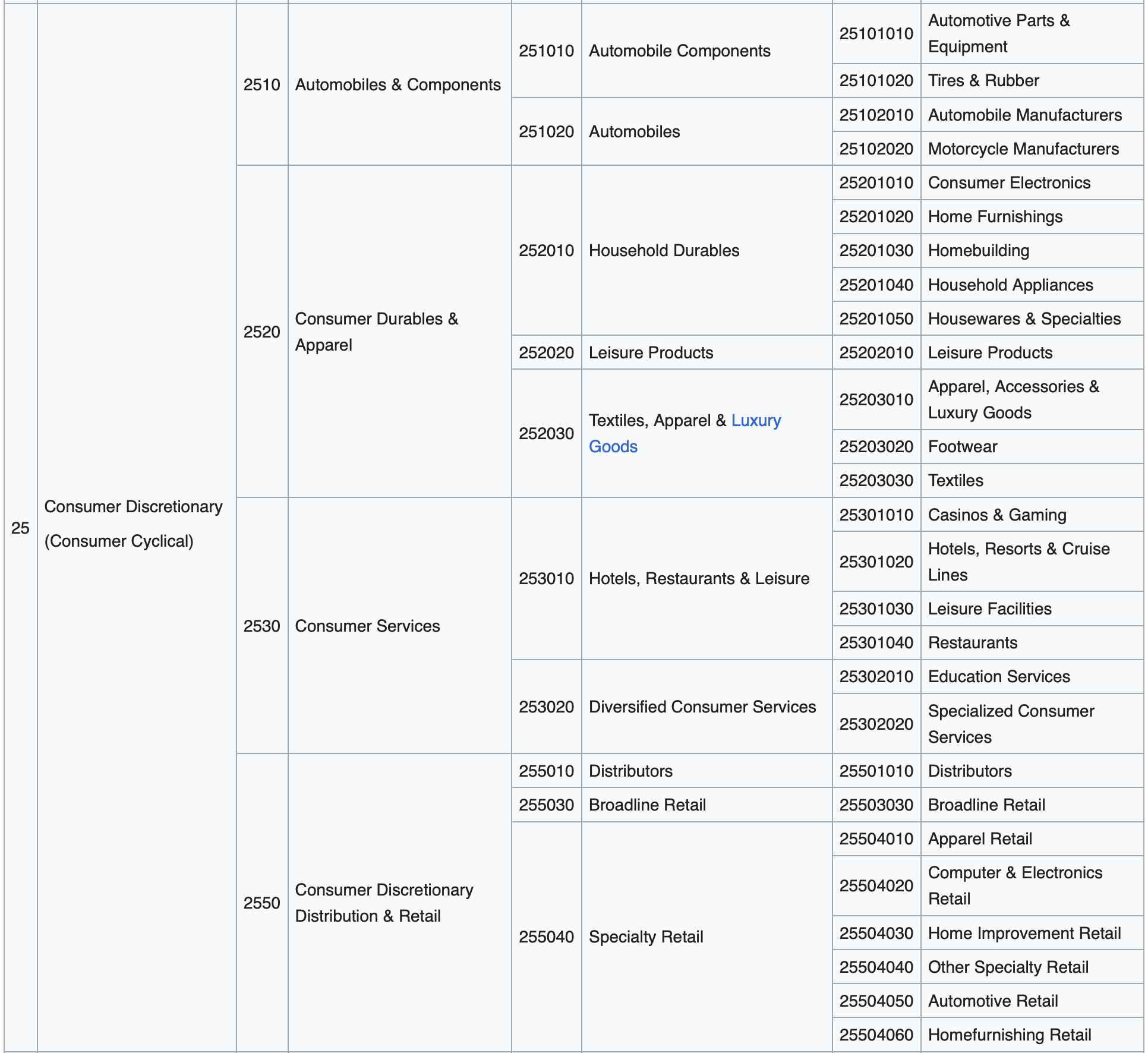

Here's a map of the Consumer Discretionary GIC code:

Looking more closely

We can sharpen our categorization framework to describe the characteristics of the financial, tech and consumer discretionary industries.

In the financial industry, customers play loose in good times and very quickly fly to safety in bad times. Safety, in this sense, means financial stability and implicit government backing, which equate to trust.

We saw this dynamic with painful clarity during the recent SVB/Silvergate/Signature banking crisis.

Tech companies, by contrast, may see reduced product or services sales or declining ad revenue in a downturn, but in general, they do not see large-scale customer losses or extended periods of significantly reduced user activity.

Success in consumer discretionary is a social phenomenon. Popular companies leverage the customer acquisition advantages of strong organic demand to embed among the primary needs of users and persist, even if their products are interchangeable with competitors' or not strictly necessary for the survival of their customers.

This dynamic dictates the fate of the largest consumer digital banking, investments, lending, insurtech and crypto companies much more than prevailing tech multiples or Fed interest rate policy do.

What does this mean?

If you're a fintech, what does this mean?

To me, it means that founders must scrutinize the dynamics that exist between their companies and their customers.

As useful as frameworks are for seeing the forest for the trees, they are not sufficient for building a successful business.

When we built BELLA starting in 2019, we recognized that consumer digital banks are consumer discretionary businesses, and we designed accordingly.

Customers don't choose most consumer fintechs because they have an unmet need or no alternative options.

So, why do they choose them? In the long run, it's not because of the frictionless onboarding flow, payment processing time or even higher savings interest rate. It's because of how they make people feel, reinforced by consistent utility and good UX.

Consumer discretionary is about the self-identity of the consumer, the feelings they have when they use a product or interact with a brand. The most successful consumer companies in the world embody this.

There's a huge opportunity to apply a consumer discretionary lens to fintech, wrapped around strong unit economics, to shape a new narrative.