Fintech Valuations in a Macro Hurricane

Fintech valuations have gotten crushed over the past few months, with growth capital availability and public market comps plummeting due to macro conditions.

If you're a publicly traded fintech like Robinhood, Coinbase, SoFi, Square/Block, MoneyLion, Payoneer, Dave, Remitly, Nubank, PayPal or many others, you're feeling the pain.

Of course, fintech is not alone. The broader markets are in free fall, with the S&P 500 now squarely in bear market territory (down >20% from highs earlier this year). But our job here is to go deep on fintech.

In the analysis below, we break down the macro, fundamental and business model reasons that fintech valuations are struggling, and we offer thoughts on where we can go from here.

To augment the written analysis, or if you prefer audio only, I encourage you to listen to the podcast conversation I recently had on this topic. I was hosted for an amazing deep dive discussion by Lex Sokolin, the brain behind the Fintech Blueprint and the Head Economist & Global Fintech Co-Lead at ConsenSys.

In the wide ranging podcast episode, we discussed operating frameworks for navigating difficult markets, valuation multiples, fintechs as tech companies vs. balance sheet businesses, implications for BNPL and other fintech verticals, and much, much more.

There are some great resources floating around that I used to prep for the conversation, including A Framework for Navigating Down Markets by a16z and The fintech winners and losers from higher interest rates by Tellimer.

Now, on to our extended analysis.

The Macro Environment

The macro environment is pulling asset prices down across the board as, in the US especially, inflation continues to run rampant, despite early tightening actions taken by the Fed. More, meaningful interest rate hikes are planned, which investors currently fear will push the economy into a painful and potentially lengthy recession.

This is bad news for all companies, especially consumer discretionary businesses, risky lenders and those without strong economic fundamentals.

Fundamentals

The Fed fights inflation with higher interest rates, which slow growth. If overdone, this tightening results in layoffs and lower consumer spending. Finance people see a few related impacts on business fundamentals from this scenario, including:

- Higher interest rates reduce the present value of future cash flows and therefore lower valuations.

- Higher interest rates increase the cost of capital, driving up return requirements and therefore bringing additional scrutiny to early & growth stage investments.

- Capital is simply more costly/difficult to come by, so there is less competition for deals, and valuations fall. It's an investor’s market.

- In a risk-off/recessionary environment, asset managers rotate out of high risk investments toward companies that perform better at this stage of the cycle.

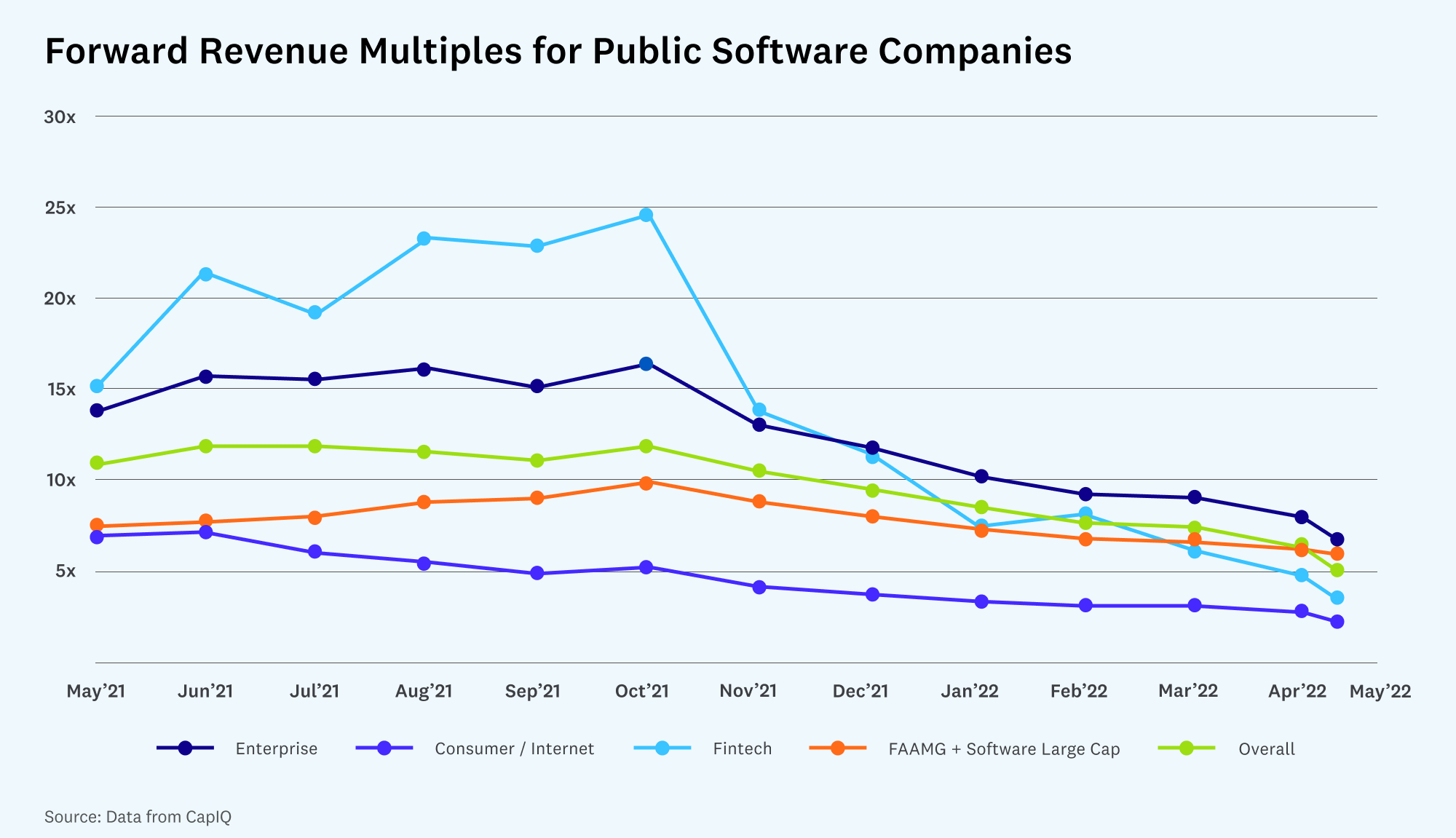

Importantly, markets and capital flows are all interrelated, which has resulted in an alignment of public and private market valuations in the current environment, following years of significant private market premiums. According to data collected by a16z, as of May, public fintech valuations were down close to 90% from peaks (and are surely down further through mid-June).

There are a number of structural pressure points on fintech valuations right now, including:

- Many VCs/PE/strategic funds have flexibility to determine where they invest and may currently view established, publicly traded fintechs like PayPal or Square/Block to be higher quality long term investments at current valuations than higher risk, private, early/growth stage companies.

- VC LPs can allocate funds to other investment strategies, favoring lower risk asset classes and reducing the amount of capital available to early/growth stage businesses, putting downward pressure on valuations.

- Some investors must mark investments to market, including investments in startups. Valuations used for this exercise must pass auditor/SEC muster. They can also at times be overly conservative, as there can be benefit to public companies in taking pain upfront and overdelivering in the future. If one investor publicly marks down a private company investment, it is difficult for the company itself or other investors to justify meaningfully higher valuations. For example, Fidelity cut its valuation of Stripe by 13% in May, setting a benchmark for the market.

Profitability

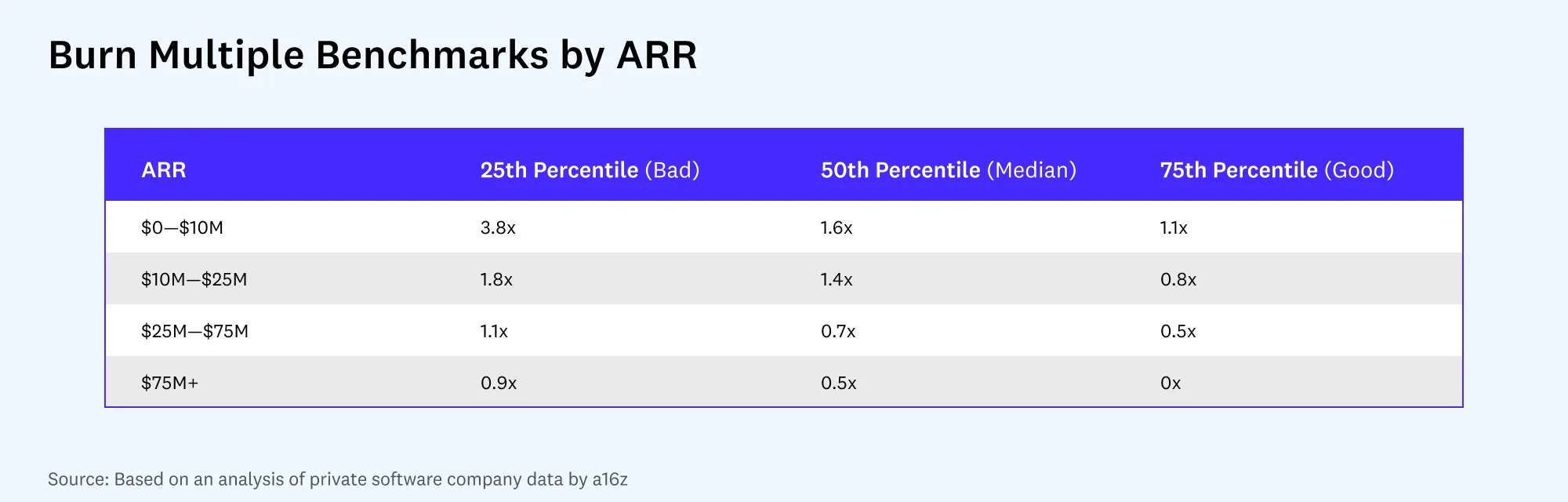

All that said, the most important (and controllable) factor impacting fintech's success is the financial sustainability of companies throughout the industry. So far, the "profitability will come" narrative that was pitched to fuel the rise of many finechs hasn’t played out. Most consumer fintechs across verticals including digital banking, investments, stock trading, PFM, insurtech and more bet on low-margin business models that theoretically work at significant scale. In many cases, either that scale hasn't been achieved or costs haven't tapered as quickly as anticipated.

Metrics like margins, LTV/CAC and the total cost of adding revenue describe the financial health of businesses. Strong economics ultimately characterize successful businesses.

Many fintechs have a lot to prove in this dimension.

Cyclicality

Counterintuitively, most consumer fintechs are consumer discretionary businesses, with the notable exception of services for the financially excluded, so revenues and growth are highly recession prone.

Correlation with consumer spending

In practice, lending, including BNPL, and payments are obvious examples, with many fintech products targeting retail, e-commerce, travel, hospitality and other discretionary spend types. In my experience, fintech penetration is relatively low among fundamental, recession proof needs like shelter, utilities and groceries (with some exceptions). As a result, when consumer propensity to spend falls, fintech usage suffers.

Credit/origination risk

Short track record lenders with limited underwriting and risk management histories are always hit hard at this stage of the cycle by defaults.

Furthermore, recent data suggests that BNPL providers are largely perfect substitutes for each other, meaning competition is high for each new loan, even to existing customers.

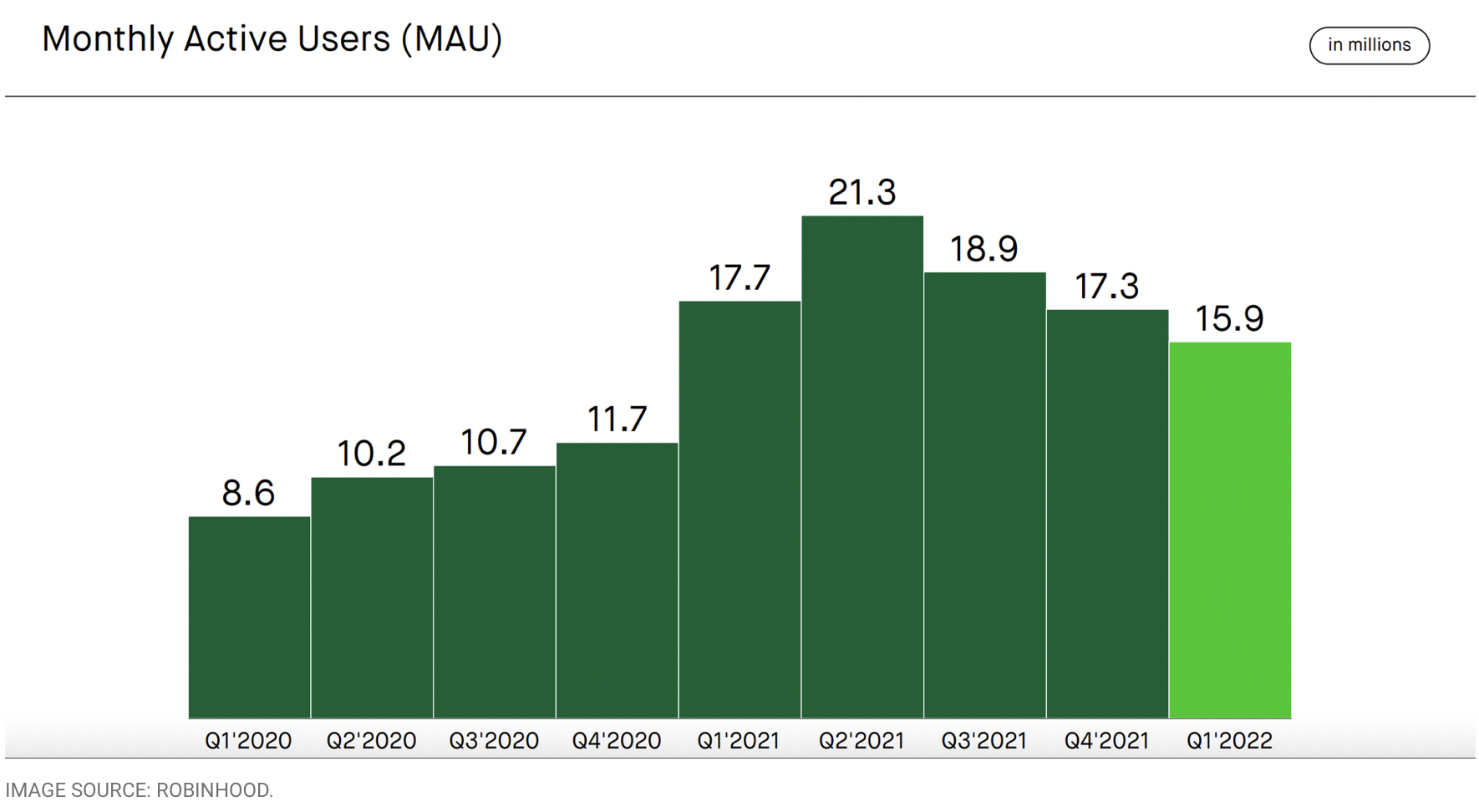

Stock & crypto speculation is discretionary spending

Lastly, over the last few quarters, we've seen from Robinhood and Coinbase's filings that customer growth and trading volumes in free stock trading & crypto apps are highly correlated with stock prices and, naturally, disposable income.

Tech Company vs. Balance Sheet Multiples

Last year, Chime famously settled with the State of California over language in its advertising suggesting that it was a bank, setting a precedent in the digital banking industry. Following the ruling, non-bank fintechs have adopted prominent wording clarifying to customer that they are financial technology companies, not banks.

Considered a blow to the industry at the time in the context of credibility with consumers, this important distinction has nonetheless been used by fintechs for years to justify higher multiples than incumbent financial services peers.

Capital intensive financial services companies, including banks and non-bank lenders, are generally valued in relation to their balance sheets, not their revenues. Internet & SaaS companies have for years achieved massive profit or revenue multiples, justified by the successes of Google, Facebook and Amazon.

The fundamental distinction between banks and tech companies, it is believed, is that code can be sold as many times as desired with negligible marginal cost, whereas capital (and indeed labor) intensive businesses like banks have scalability dynamics that require additional resources to grow.

Balance sheets aside, are fintechs really infinitely scalable like Internet/SaaS businesses, or do they share scaling dynamics with capital/labor/physical businesses, which are valued differently? The answer, I suggest, lies somewhere in the middle.

Yes, self-service, in-app account opening, banking, payments, trading etc is highly scalable using technology. However, regulatory requirements limit fast, cheap geographic expansion. Operational/support/servicing requirements for financial products are meaningfully different than for Instagram. Fraud/credit losses can be significant and scale with user numbers. Costs of services like KYC/AML, payment processing and bank account connectivity (Plaid) decline on a per-user basis but never disappear.

Fintechs often pride themselves on not being banks or balance sheet operators, which was probably a good strategy in a historically low interest rate environment. But banks' main revenue source is net interest margin on loans vs deposits, which becomes significant as interest rates rise. Yes, lending is risky, but by not considering the range of revenue streams available to financial services companies, fintechs risk limiting their success over the cycle.

It gets better from here

As difficult as it feels right now, the sun will shine again. Consumer behavior increasingly requires amazing, instant, frictionless financial services, and our industry is delivering them. We have an opportunity to reset, focus on fundamentals and build some amazing businesses over the next few years, without the noise of the recent hype cycle.

Specifically, we must focus on sustainable economics, healthy revenue mix and meeting customer needs over time (not just during bull markets). If we do this, while focusing on the scale of the opportunity and timeframe at hand, we will deliver the future we've all been working for.

I'll wrap up with a quote from the conversation with Lex, which summarizes my thoughts on our opportunity in the coming months:

"I think the best companies are founded and built in hard times. If you build a company, if you design a business model, if you design operating models, if you design economics and you raise money from scrutinizing investors during a difficult period of time, that company's much more likely to be successful in any economic conditions. Much more than the more opportunistic, speculative company that's designed to work in boom times. Now innovation definitely comes from both places, but real enduring value will be created and honed during what may be a bearish period."