GAFA and Banking: The Next Battleground (Guest Post)

By Alessandro Hatami, Managing Partner at The Pacemakers

I got my first iPod in 2002 – it was my first Apple product. I had had a Sony Walkman for a long time and had recently moved on to their MiniDisc player, but the iPod was so much better. It changed the way I listened to and bought music, creating a powerful connection for me to Apple that still persists. Today, I have an iPhone, an iPad and a MacPro. My kids and better half are all on Apple, our home Wi-Fi runs on AirPlay and we watch AppleTV. This dependency on Apple started with the iPod, and it is now touching multiple aspects of my life.

A similar process happened with Amazon, when I bought The Social Baby the month after my second daughter was born. I started using Google when they proved to be so much better at searching than Altavista and Netscape. And last but not least, I got onto Facebook about 11 years ago, and I still use it to keep in touch with friends (luckily, I don’t use them as a source of news).

Google, Apple, Facebook and Amazon (GAFA) got my loyalty by finding real connections to me and my life. They then built on these to create a real relationship with me, by giving me what I needed better than anyone else had done before.

The same will probably happen when they will eventually enter the world of financial services. They will go about it in different ways, but all four will have one objective in mind – too keep me as a customer by delivering relentless value.

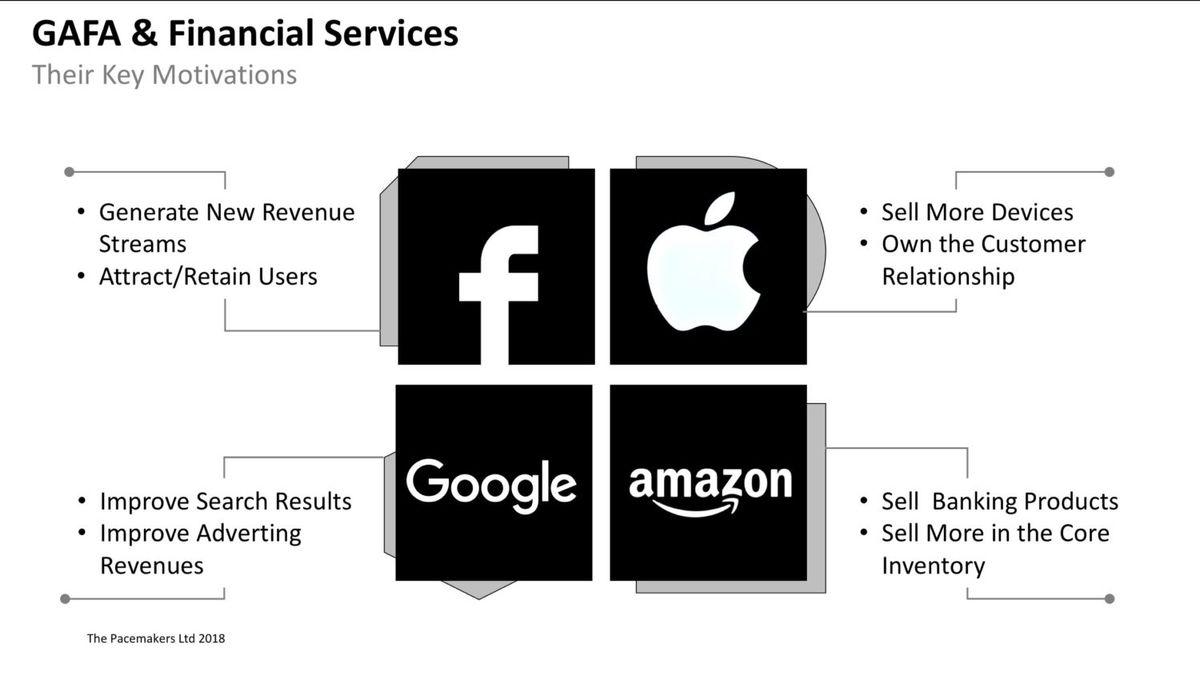

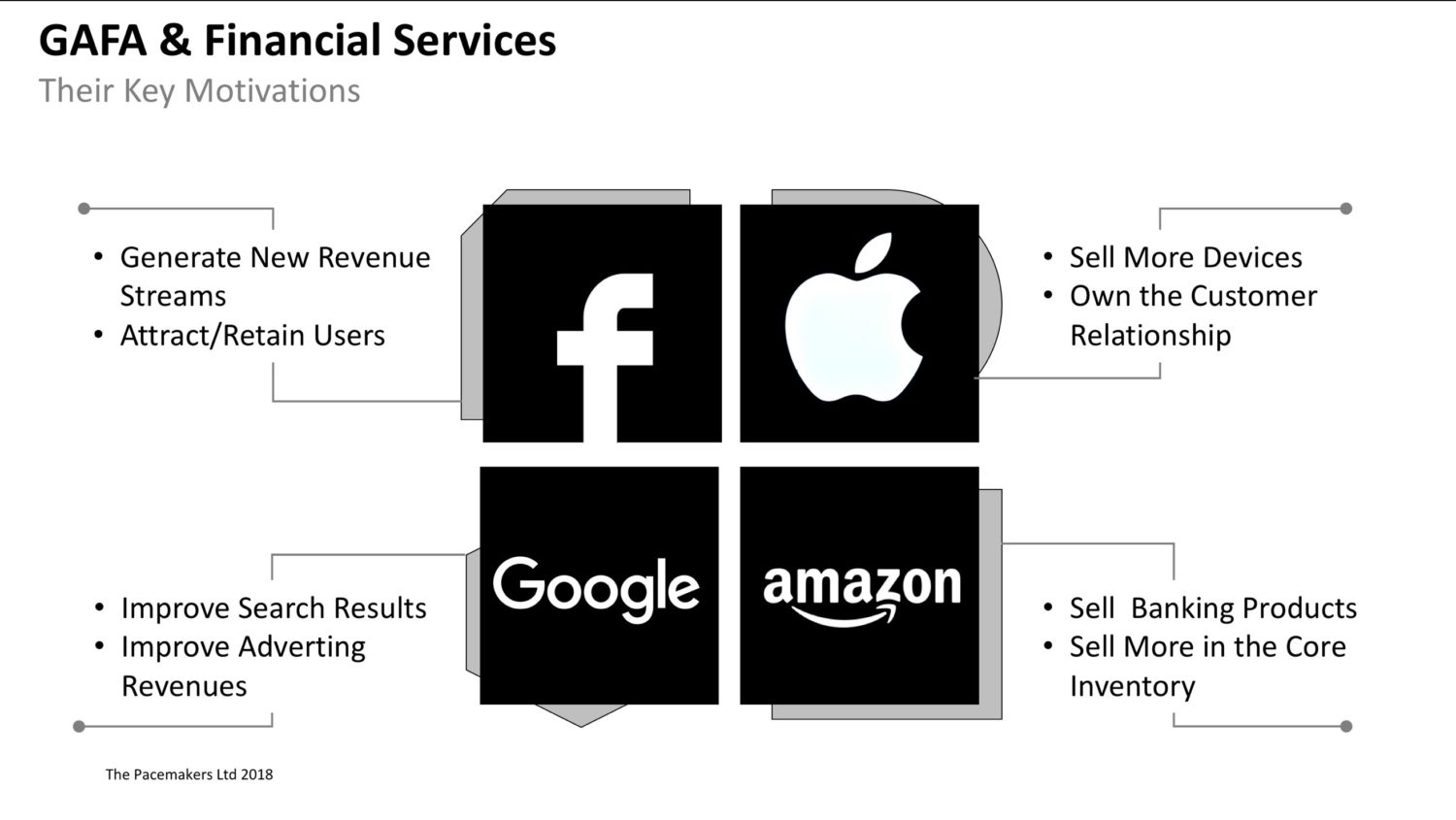

Let’s take a look at what motivates them:

Google’s main incentive in entering financial services is access to data. By entering financial services, they will gain access to a completely new data source that they can use to make their core business even more profitable.

If we oversimplify things: much of Google’s revenues come from placing ads next to the results of their clients’ queries. Making the responses to these queries more accurate, and the ads placed next to them more relevant, will generate more revenue for Google.

Furthermore, by being able to verify that the customer actually bought a product they searched for on Google, they would be able to charge advertisers on a much more lucrative PPA (pay per action) basis rather than the current PPC (pay per click) model.

Also, Google has been investing heavily in Artificial Intelligence. By using AI with the data they already hold on consumers supplemented by financial data, Google will be able to become an unbeatable channel for consumers to find the ideal financial product from any bank – not just their legacy provider. One destination to find anything.

Apple

Apple wants its customers to keep buying Apple. They want to make sure your next digital device is one of theirs. By connecting more aspects of their customers’ lives with their products, they aim to become a (or the) gateway through which they manage their lives – as Steve Jobs’ famous Digital Hub speech in 2002 proposed.

Apple therefore needs to extend its offering to finance and banking. To succeed, they will need to make their customers’ engagement with their bank through Apple a more efficient and “pleasant” experience than going direct (either physically or digitally).

Apple clearly realises the importance of payments in achieving this. They are rolling out ApplePay across the globe and vigorously challenging protective moves from incumbent banks. Looking at their track record on how they dis-intermediated the record companies and the telcos, they have a good chance of succeeding.

Facebook makes most of its revenues by selling advertising, very much as a publisher would (even though they do not like to be reminded of that). They provide content their users care for - often original content created by their users and their friends - and they show them ads relevant to these posts in the process. The more time users spend on Facebook, the more ads they will see and therefore the more Facebook will earn.

Facebook is interested in providing financial services for two reasons. Firstly, access to their users’ financial data, to complement the data they already collect on them, would deeply enhance the accuracy of their targeted ads. But also, providing payments and other financial services would allow them to go beyond advertising to create new revenue streams.

The model they probably aspire to is that of WeChat in China, where users can complete many of their daily tasks while on the app – from messaging friends and booking restaurants to paying for taxis and babysitters. The success of Tencent – WeChat's owner – is enviable.

The first indications of Facebook's plans are the eMoney licenses the company was recently granted in Spain and Ireland and the recent hires of senior experienced payments professionals.

Amazon

Amazon already sell some financial products. They have offered consumer cards for many years and are looking at working capital finance to support their merchants – all through partners. Most recently, they have announced the launch of a current account in partnership with JPMorgan Chase. This latest offering could be indication of new things to come.

As a retailer, Amazon wants to sell more products. By providing a current account, they can get a much better understanding of their customers’ financial characteristics and score them accordingly. The lowest hanging fruit here is to offer point of sale financing, increasing the sales of their core products. The real prize is to authenticate and rate their customers so that they can buy relevant financial products (loans, mortgages, savings accounts, pensions etc) at the click of a button – as they would buy any other product on Amazon. Amazon would display only products for which the customer is pre-approved by third party financial services businesses and banks. This would provide customers unprecedented range and ease in buying the financial products they need.

The launch of the current account with JPMC could be the first step in creating a platform through which Amazon can sell other financial products. In this scenario Amazon – and not the banks – could become the first port of call when customers look for a new financial product.

What is most striking about the GAFA interest in banking is that they do not seem to care too much about the actual financial services revenues. This means that in most instances, and where allowed by the regulators, they would probably prefer to not be financial institutions. The burden and complexity of financial rules and regulations are simply not worth it to them. They would very much prefer being a layer between the financial institutions and customers, giving them access to customer data and the relationships they seek, while all the regulatory burden and potential liabilities remain with the banks and financial institutions.

In entering the financial services industry, GAFA and other Big Tech have access to four assets and one liability: they have many millions of customers they can engage with, they understand what motivates their customers, they have access to a broad talent pool, and they have huge capital reserves to invest. Their one liability: their brand. Will their customers feel comfortable banking with (or through) them? If the recent disclosures of Facebook’s misuse of customer data do not lead to a wider backlash in customer appetite and regulation, it is very possible that the GAFAs and other Big Tech firms will be successful in entering financial services.

Done right, this could be great for consumers, as they will gain access to a much wider set of financial products at lower prices. In the process, the relationship between banks and their customers to be even further diluted, and the bank as a utility could eventually become a reality. This will cause a real shock to the most banks’ cost and revenue structures. I’m not sure that all banks will be able to adapt – will we see a spate of bank closures and consolidation as we saw for record companies and mobile operators?

And all of this doesn’t even consider what Microsoft and BAT (Baidu, Alibaba, Tencent) decide to do next. There are stormy days ahead for banks.